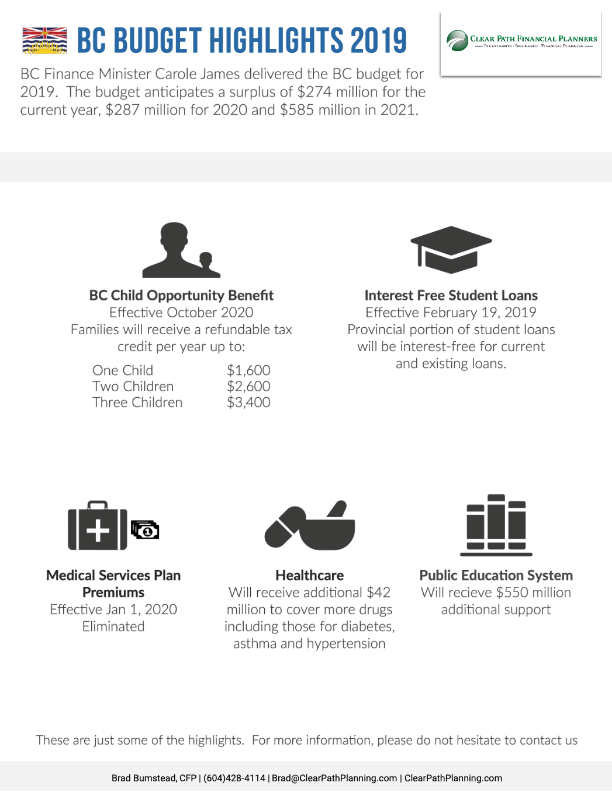

BC Finance Minister Carole James delivered the province’s 2019 budget update on February 19, 2019. The budget anticipates a surplus of $274 million for the current year, $287 million for 2020 and $585 million in 2021.

The biggest announcements are:

- BC Child Opportunity Benefit

- Interest Free Student Loans

BC Child Opportunity Benefit

The BC Child Opportunity Benefit covers all children under 18 and can be applied for starting in October 2020. (This replaces the Early Childhood Tax Benefit where the benefit ended once a child turned six.)

Starting October 2020, families will receive a refundable tax credit per year up to:

- $1,600 with one child

- $2,600 with two children

- $3,400 with three children

Families with one child earning $97,500 or more and families with two children earning $114,500 or more will receive nothing.

Interest Free Student Loans

The provincial portion of student loans will now be interest-free effective as of February 19, 2019. The announcement covers both current and existing student loans.

Medical Services Premium

As previously announced in the last budget, effective January 1, 2020, the Medical Services Premium (MSP) will be eliminated. In last year’s budget update, MSP was reduced by 50% effective January 1, 2018.

Public Education System

The public education system will receive $550 million in additional support.

Healthcare

Pharmacare program will be expanded with an additional $42 million to cover more drugs, including those for diabetes, asthma and hypertension.

To learn how these changes will affect you, please don’t hesitate to contact us.