Now that we are nearing year end, it’s a good time to review your finances. 2018 saw a number of major changes to tax legislation come in force and more will apply in 2019, therefore you should consider available opportunities and planning strategies prior to year-end.

Below, we have listed some of the key areas to consider and provided you with some useful tips to make sure that you cover all of the essentials.

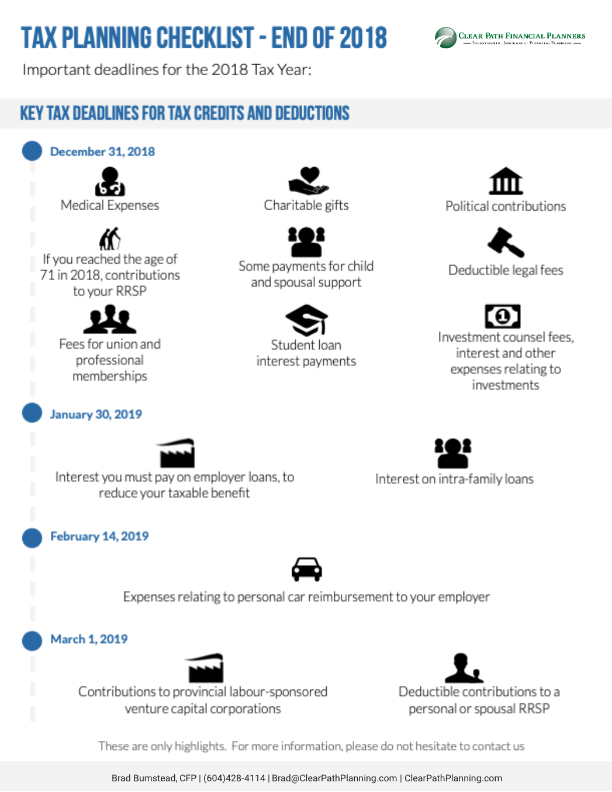

Key Tax Deadlines for 2018 Savings

December 31, 2018:

- Medical expenses

- Fees for union and professional memberships

- Charitable gifts

- Investment counsel fees, interest and other expenses relating to investments

- Student loan interest payments

- Political contributions

- Deductible legal fees

- Some payments for child and spousal support

- If you reached the age of 71 in 2018, contributions to your RRSP

January 30, 2019

- Interest on intra-family loans

- Interest you must pay on employer loans, to reduce your taxable benefit

February 14, 2019

- Expenses relating to personal car reimbursement to your employer

March 1, 2019

- Contributions to provincial labour-sponsored venture capital corporations

- Deductible contributions to a personal or spousal RRSP

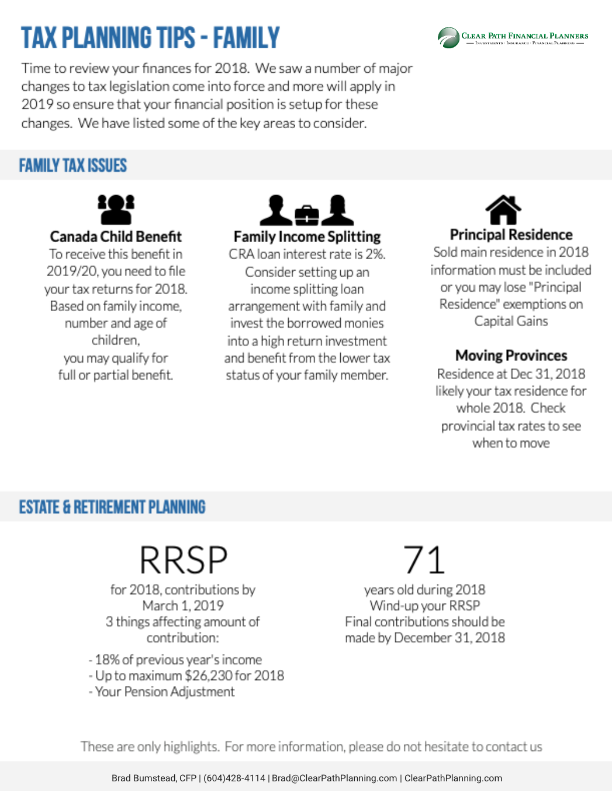

Family Tax Issues

- Check your eligibility to the Canada Child Benefit

In order to receive the Canada Child Benefit in 2019/20, you need to file your tax returns for 2018 because the benefit is calculated using the family income from the previous year. Eligibility depends on set criteria such as your family’s income and the number and age of your children and you may qualify for full or partial amount. - Consider family income splitting

The CRA offers a low interest rate on loans and it therefore makes sense to consider setting up an income splitting loan arrangements with members of your family, whereby you can potentially lock in the family loan at a low interest rate of 2% and subsequently invest the borrowed monies into a higher return investment and benefit from the lower tax status of your family member. Don’t forget to adhere to the new Tax on Split Income rules. - Have you sold your main residence this year?

If so, your 2018 personal tax return must include information regarding the sale or you may lose any “principal residence” exemptions on the capital gains from the sale and thus make the sale taxable. - If you’re moving, think carefully about your moving date

If you are moving to a new province, it’s worth noting that your residence at December 31, 2018 is likely to be the one that your taxes are due to for the whole of the 2018 year. Therefore, if your move is to a province with higher taxes, putting your move off until 2019 may therefore make sense, and vice versa if you are moving to a lower tax province.

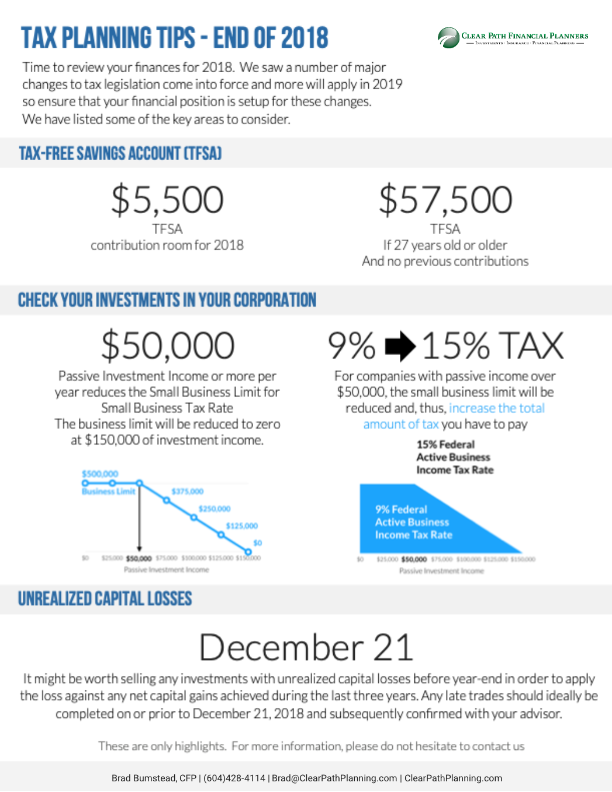

Managing Your Investments

- Use up your TFSA contribution room

If you are able, it’s worth contributing the full $5,500 to your TFSA for 2018. You can also contribute more (up to $57,500) if you are 27 or older and haven’t made any previous TFSA contributions. - Check if you have investments in a corporation

The new passive investment income rules apply to tax years from 2018 and you therefore need to plan ahead if the rules affect you. They state that the small business deduction is reduced for companies which are affected with between $50,000 and $150,000 of investment income, therefore the small business deduction has been stopped completely for corporations which earn passive investment income of more than $150,000. - Think about selling any investments with unrealized capital losses

It might be worth doing this before year-end in order to apply the loss against any net capital gains achieved during the last three years. Any late trades should ideally be completed on or prior to December 21, 2018 and subsequently confirmed with your broker. Conversely, if you have investments with unrealized capital gains which are not able to be offset with capital losses, it may be worth selling them after 2018 in order to be taxed on the income the following year.

Estate and Retirement Planning

- Make the most of your RRSP

The deadline for making contributions to your RRSP for the year 2018 is March 1, 2019. There are three things that affect how much you may contribution towards your RRSP, as follows:- 18% of your previous year’s earned income

- Up to a maximum of $26,230 for 2018 and $26,500 for 2019

- Your pension adjustment

Remember that deducting your RRSP contribution reduces your after-tax cost of making said contribution.

- Check when your RRSP is due to end

You should wind-up your RRSP if you reached the age of 71 during 2018 and your final contributions should be made by December 31, 2018.

Other Considerations

- Make your personal tax instalments

If you pay your final 2018 personal tax instalment by December 15, 2018, you won’t pay interest or penalty charges. Similarly, if you are behind on these instalments, you should try to make “catch-up” payments by that date. You can also offset part or all of the non-deductible interest that you would have been assessed if you make early or additional instalment payments. - Remember the deadline for making a taxpayer-relief request

The deadline is December 31, 2018 for making a tax-payer relief request related to the 2008 tax year. - Consider how to minimize the taxable benefit for your company car

The taxable benefit applied to company cars is comprised of two parts – a stand-by charge and an operating-cost benefit. If you drive a company car, it’s worth considering how to potentially minimize both of these elements. The taxable benefit for operating costs is $0.26 per km of personal use, therefore you should make sure that you reimburse your employer where relevant, by the deadline of February 14, 2019.

Contact us if you have any questions, we can help.