Clear Path Financial Planners Blog

Why Advisors Should Consider a Website Design

We were recently featured in the Globe and Mail speaking about designing websites and content for financial advisors and integrating it with social and email newsletters. In the article we talk about how advisors can use their website to grow their business.

We are grateful to the advisors that choose us to be their content and website provider and giving us the opportunity to grow with them. Thank you to the Globe and Mail for shining a spotlight on Financial Tech Tools.

Applications for Canada Recovery Benefit now open!

The Canada Recovery Benefit (CRB) is now open for applications.

If you are eligible for the CRB, you can receive $1,000 ($900 after taxes withheld) for a 2-week period.

If your situation continues past 2 weeks, you will need to apply again. You may apply up to a total of 13 eligibility periods (26 weeks) between September 27, 2020 and September 25, 2021.

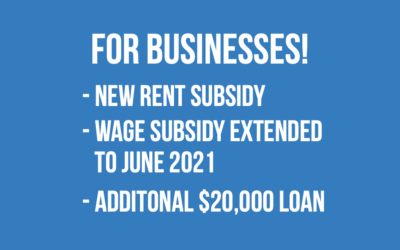

New Canada Emergency Rent Subsidy | Wage Subsidy extended | CEBA additional $20,000 loan

Great news for businesses! The new Canada Emergency Rent Subsidy will be available directly to business owners who need rent relief. The Wage Subsidy has been extended to June 2021. And the CEBA has been expanded to provide up to $20,000 interest-free loan.

Applications for Canada Recovery Sickness Benefit and Caregiving Benefit starts today!

Starting October 5, 2020, the Government of Canada will be accepting online applications for the Canada Recovery Sickness Benefit (CRSB) and the Canada Recovery Caregiving Benefit (CRCB).

Estate Planning for Young Families

Estate Planning for Young Families

Throne Speech: Recovery Plan Highlights

On September 23rd, in a speech delivered by Governor General Julie Payette, Prime Minister Justin Trudeau outlined the Federal government’s priorities.

Support for Black entrepreneurs and business owners

On September 9th, 2020, Prime Minister Justin Trudeau announced Canada’s first-ever Black Entrepreneurship Program that will help thousands of Black business owners and entrepreneurs across the country.

CEBA extended to October 31st. Expanded to include more businesses.

On August 31st, Deputy Prime Minister and Minister of Finance Chrystia Freeland announced the extension of the Canada Emergency Business Account (CEBA) to October 31st, 2020. This will give small businesses 2 additional months to apply for the $40,000 loan.

In addition, the Federal Government said it was working with financial institutions to make the CEBA program available to those with qualifying payroll or non-deferrable expenses that have so far been unable to apply due to not operating from a business banking account.

Financial Planning for Incorporated Professionals

Financial planning for incorporated professionals is often two-sided- planning for the practice and personal financial planning.