You’ve likely heard much about interest rates, especially house prices and mortgages. Rising interest rates will impact everyone, whether they are borrowers or savers.

Why does the Bank of Canada raise interest rates?

The Bank of Canada has a monetary policy. The policy has two parts: an inflation target and a flexible exchange rate.

To achieve low and stable inflation, the Bank of Canada tries to keep inflation close to a target range of 1% to 3%. They use this target in deciding on the policy interest rate, also known as the target interest rate. They are committed to keeping inflation from rising too quickly. One of the ways the Bank of Canada can help slow down quick-rising inflation is by raising interest rates.

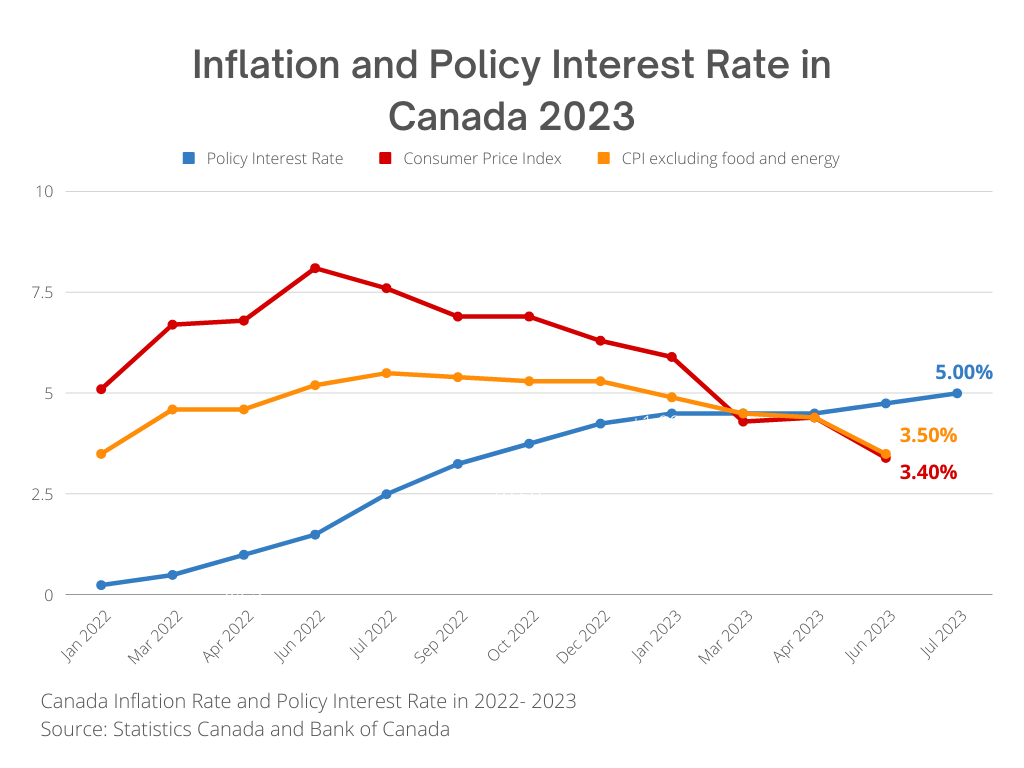

The chart below shows the increase in policy interest rates and the changes in the annual inflation rate from the Consumer Price Index.

Source: Bank of Canada https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

Statistics Canada: https://www150.statcan.gc.ca/n1/daily-quotidien/221019/cg-a001-eng.htm

Unfortunately, it takes time for inflation to reach the consumer level. Higher interest rates make it more attractive to save money and less attractive to borrow and spend. As a result, companies tend to lower their prices to sell more goods or increase their prices more slowly; this reduces inflation.

Use the Personal Inflation Calculator to see the impact of inflation unique to you: https://itools-ioutils.fcac-acfc.gc.ca/MC-CH/MC-CH-eng.aspx

How does the Bank of Canada’s interest rate affect the prime rate?

The Bank of Canada’s policy interest rate impacts how much it costs banks to borrow from the Bank of Canada. In turn, this impacts banks’ prime rates as they will modify their prime rates to offset the increased cost of borrowing money from the Bank of Canada.

History of Interest Rates

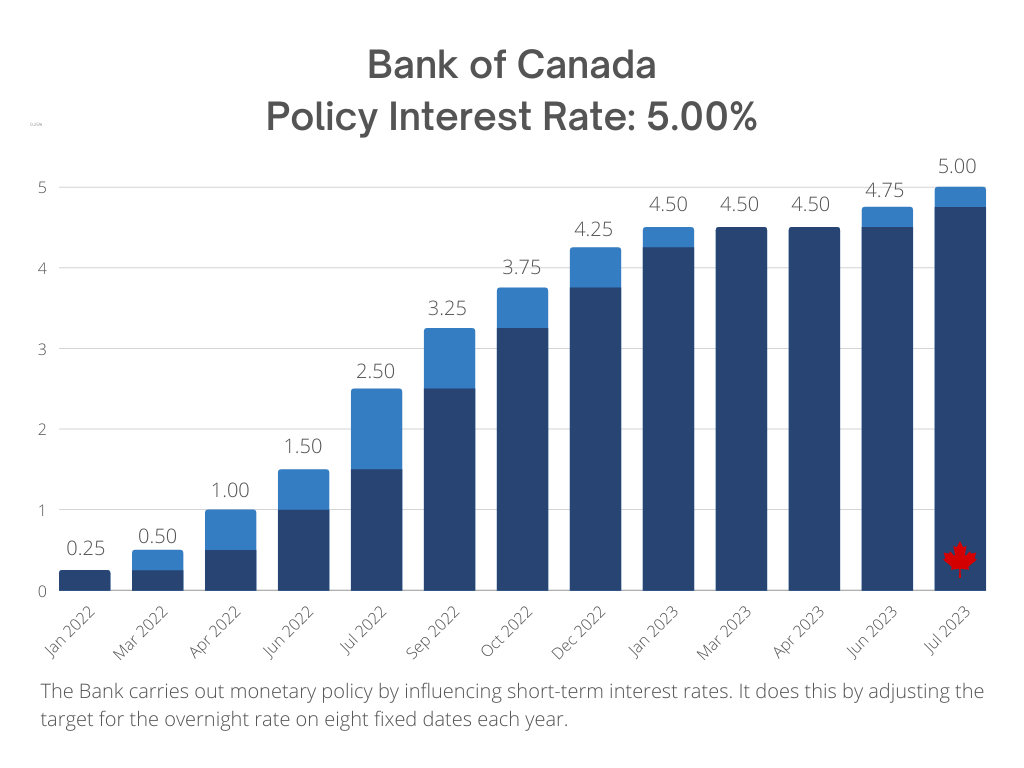

Since 2022, the Bank of Canada has raised its key interest rate.

Source: Bank of Canada https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

What happens to loans when interest rates rise?

For borrowers, the most noticeable thing that happens when interest rates go up is the cost of borrowing increases. The rates affect the interest rates you pay on:

-

Mortgage

-

Home equity line of credit

-

Other forms of credit include personal loans, investment loans, lines of credit

How does this affect mortgages?

The impact will vary depending on your specific situation:

If you already have a fixed-rate mortgage, a higher interest rate won’t affect your mortgage payments for the term of your loan. However, you may be renewing at a higher rate when it’s time to renew, which means less of your hard-earned money is going toward paying down your principal loan.

If you have a variable-rate mortgage, your payments will increase as the prime rate increases. Therefore, there’s a high likelihood that your payments will increase within the next month.

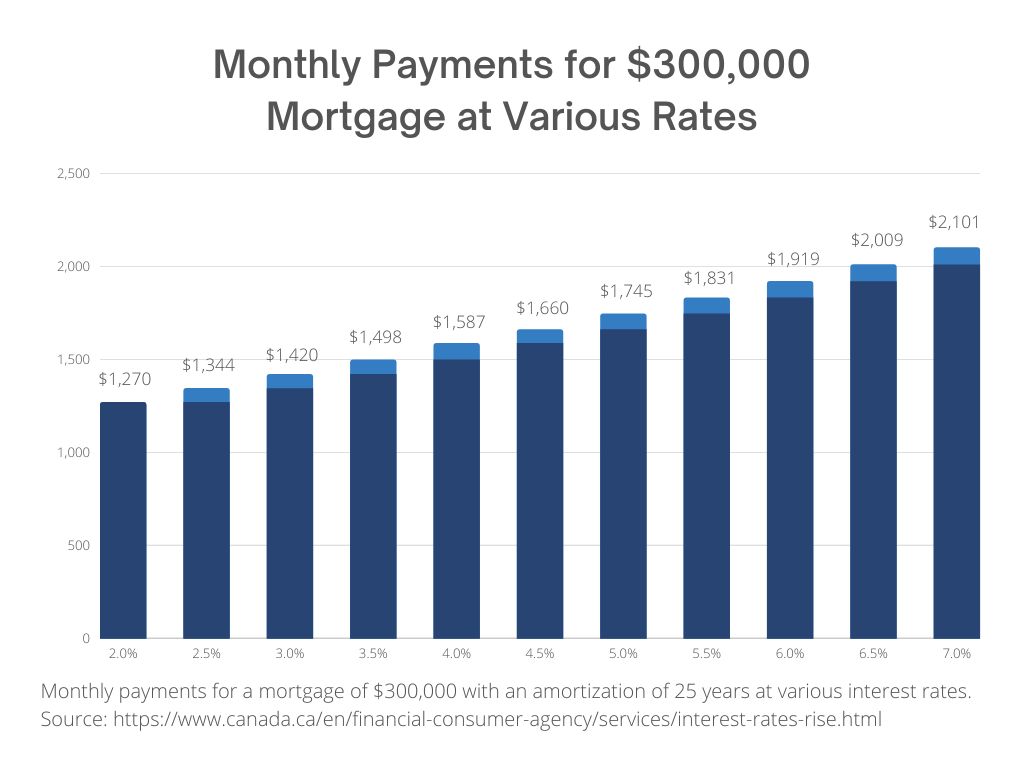

Example: Monthly payments for a mortgage of $300,000 with an amortization of 25 years at various interest rates.

Source: Financial Consumer Agency: https://www.canada.ca/en/financial-consumer-agency/services/interest-rates-rise.html

Use the Mortgage Calculator to see the impact of an interest rate increase on your mortgage: https://itools-ioutils.fcac-acfc.gc.ca/MC-CH/MC-CH-eng.aspx

How does this affect personal loans?

If you have a variable-rate loan, your payments will increase as the prime rate increases.

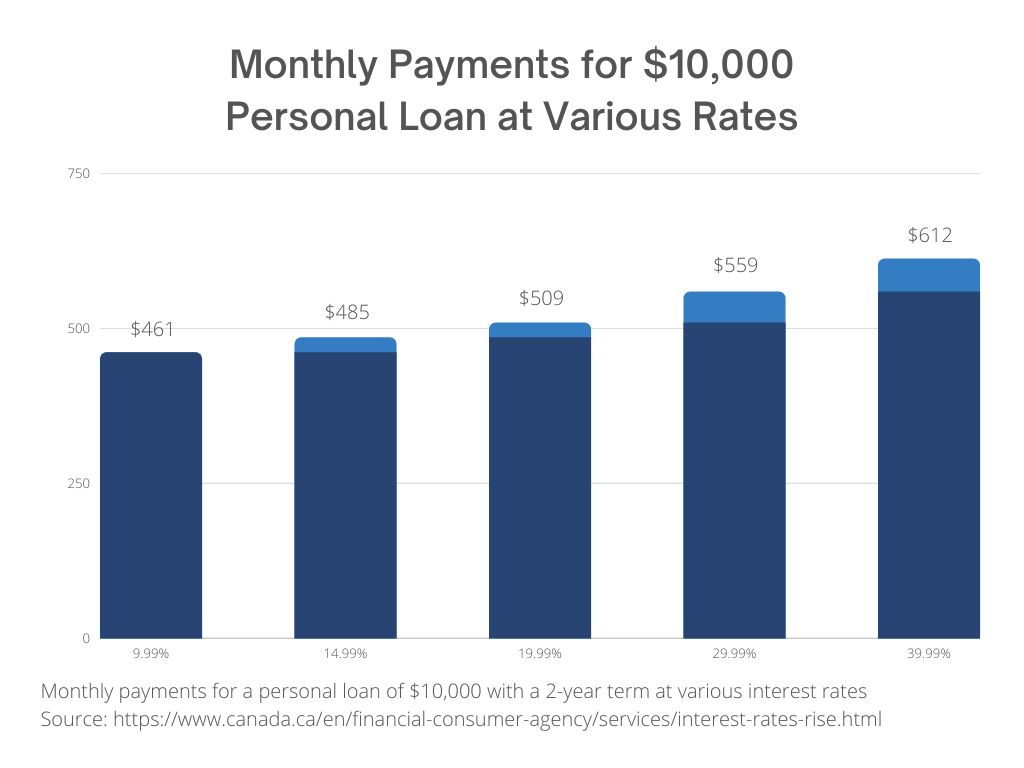

Example: Monthly payments for a personal loan of $10,000 with a 2-year term at various interest rates.

Source: Financial Consumer Agency: https://www.canada.ca/en/financial-consumer-agency/services/interest-rates-rise.html

In the example above, suppose you have a personal loan of $10,000 with a variable interest rate and a 2-year term. Your interest rate is 14.99%.

Your loan payment will increase by $24 a month if interest rates rise by 5%. That adds up to $552 more in interest over the two years.

How does the Bank of Canada’s interest rate change affect saving money?

For savers, when the rate increases, individuals can potentially earn a higher interest rate on their savings accounts because financial institutions have more flexibility to compete on the interest rates they offer. This could mean you get an increase in GICs (Guaranteed Investment Certificates) rates. In addition, as interest rates continue to rise, you may start to see competitive pressure to increase these accounts’ interest rates. Therefore, it’s best to shop for GIC rates.

What can you do to prepare?

These are our top tips for preparing for rising interest rates:

1. Talk to us to review your current financial situation, including:

-

Debt Load

-

Savings- Is it time to put money into a high-interest account?

-

Investments- Are your investments aligned with your financial goals?

-

Your financial goals- are you on track for retirement, buying a home, vacation, or saving for your children’s education?

-

Insurance- are you and your family adequately protected in case of the unexpected?

2. Talk to your lenders to find out how much your payments will increase. Review all loans and their terms, including interest rates. Loans to review are:

-

Credit Card

-

Lines of Credit

-

Personal Loans

-

Investment Loans

-

Mortgage

Consider paying off or consolidating your high-interest debt. This will help you minimize the interest you pay, give you more money for other things, and make it easier to manage your payments.

3. Talk to your mortgage broker, discuss the difference between your current variable rate mortgage and choosing to move to a fixed-rate mortgage and what makes the most sense. Use the Mortgage Calculator to see the impact of an interest rate increase on your mortgage: https://itools-ioutils.fcac-acfc.gc.ca/MC-CH/MC-CH-eng.aspx

4. Create a budget. Figure out what you can afford currently. Use the Personal Inflation Calculator to see the impact inflation has on your budget: https://itools-ioutils.fcac-acfc.gc.ca/MC-CH/MC-CH-eng.aspx

Need help?

Still, have questions? We’re here to help – reach out to us today!

Sources:

-

https://www150.statcan.gc.ca/n1/daily-quotidien/221019/cg-a001-eng.htm

-

https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

-

https://www.canada.ca/en/financial-consumer-agency/services/interest-rates-rise.html

-

https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2020015-eng.htm

-

https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2018016-eng.htm

-

https://www.manulifebank.ca/personal-banking/mortgages/manulife-one.html